A new way to help us

Gifts of Securities... An attractive alternative in Scarboro Missions' Planned and Asset-giving Program

By Matt Gleeson

April 2006

Return to Table of Contents

Print Article

The donation of "blue-chip" stocks or securities has become a most popular form of Asset Giving in recent years. Current tax laws make the donation of securities an attractive alternative to other types of charitable giving. Until this year, any capital gains realized on the donated stock or securities were taxable to the donor at the rate of 25% of the value of the gain or profit earned on the shares.

It is anticipated that the first Conservative government budget will contain a new provision whereby the 25% capital gains tax on donated securities will be removed completely. This tax exemption will, no doubt, influence and encourage more holders of blue-chip stocks to consider donating a portion of profits earned on their stock portfolios to charities such as Scarboro Missions.

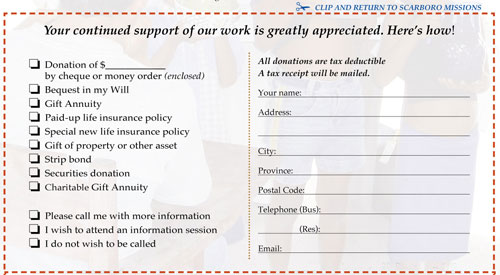

For further information on the possible donation of securities and other Planned and Asset Giving options, please complete the information request below and return it to:

Scarboro Missions

2685 Kingston Road

Scarborough, ON M1M 1M4

Fax: 416-261-0820; Tel: 416-261-7135; Toll-free: 1-800-260-4815

Email: to@scarboromissions.ca

Matt Gleeson is Scarboro Missions' Planned Giving Consultant.

Return to Table of Contents

Print Article